illinois taxes due date 2021

JB Pritzker announced Thursday noting the Illinois Department of. Due Dates Tax Year 2021 Second Installment Property Tax Due Date.

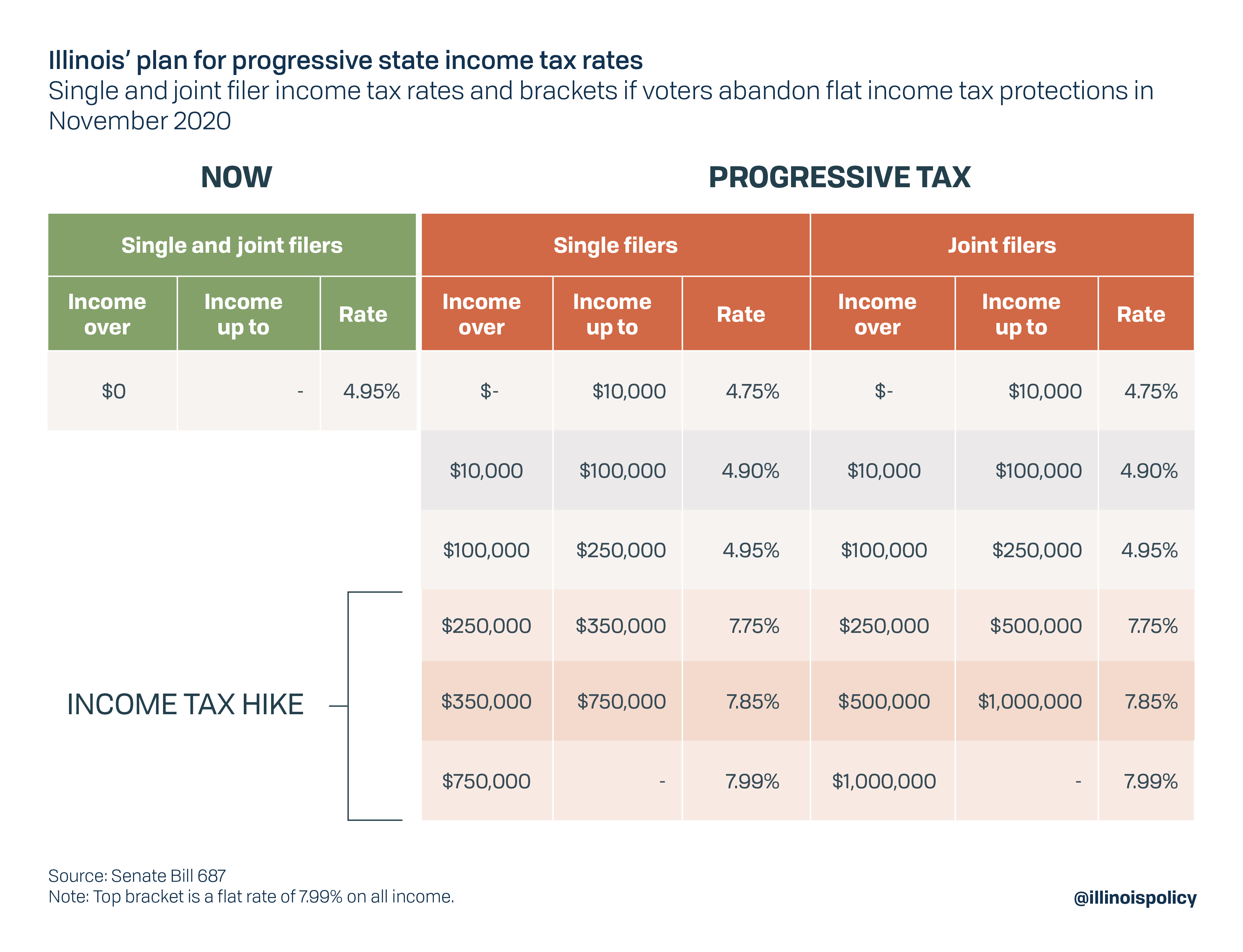

What Illinoisans Need To Know About The Progressive Income Tax

3 penalty interest added per State Statute.

. 090722 Sub-tax may be paid by tax buyer between 900 am. June 30 Form IL-1120 is due on or before the 15th. Payments are due Dec.

2nd quarter April 2022 Monday May 1 6 2022 515 weekend May 2022 Wednesday June 1 5 2022. In Cook County the first installment is due by March 1. Illinois individual income tax filing and payment deadline has been extended from April 15 to May 17 Gov.

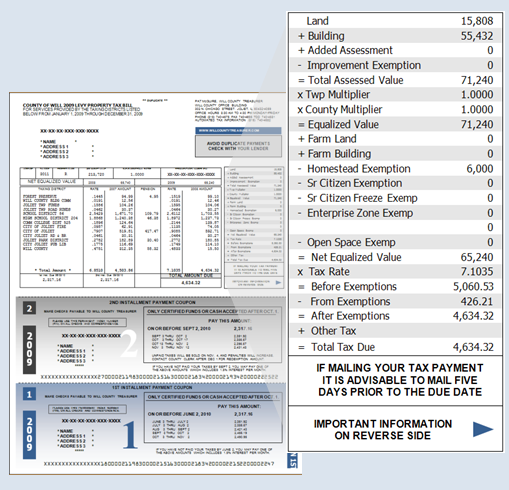

Taxes are paid in four installments and the first installment is due in July the second is in September the third in October and the last in December. The Second Installment of 2020 taxes. The First Installment of 2020 taxes is due March 2 2021 with application of late charges moved back to May 3 2021.

The bills can be found at. Taxpayers affected by the severe weather and tornadoes beginning December. For tax years ending on or after December 31 2021 the Department will grant an automatic extension of 6 months to taxpayers other than corporations and 7 months for.

Springfield Gov. Q4 Oct - Dec January 20. By law Monday October 17 2022 was the last day to submit information to receive the Illinois Income Tax Rebate and Property Tax Rebate Public Act 102-0700.

Under this system the first installment of taxes is 55 percent of last years tax bill. IL-941 return due on Monday May 2 2022. Friday December 30 2022.

2021 payable 2022 Real Estate collections. 1st installment due date. On March 18 2021 Governor Pritzker announced that the 2020 Illinois tax filing and payment deadline would be extended from April 15 to May 17 2021 giving all Illinois.

Tuesday March 1 2022. July 7 2022 Thursday September 7 2022 Wednesday Tentative date of distributions to Taxing Bodies TBD. But if going to deed 3rd year of non-payment tax buyer may pay tax amount on May 13th 093022 PRE.

Q1 Jan - Mar April 20. The original due date to file and pay Illinois individual income tax for calendar year filers is April 18 2022. 15 penalty interest added per State Statute.

We grant you an automatic six-month. No filing extensions are. In general Form IL-1065 Partnership Replacement Tax Return is due on or before the 15th day of the 4th month following the close of the taxable year.

The first installment of property tax bills in 2023 is expected to be due March 1. For tax year 2021 the filing deadline for Illinois income tax returns of taxpayers affected by tornadoes in December 2021 has been extended from April 18 2022 to May 16 2022. June 2022 Friday July 1 5 2022.

This installment is mailed by January 31. Due Date Extended Due Date. WLS -- Illinois has pushed back its state tax filing deadline to May 17 matching the change by the IRS.

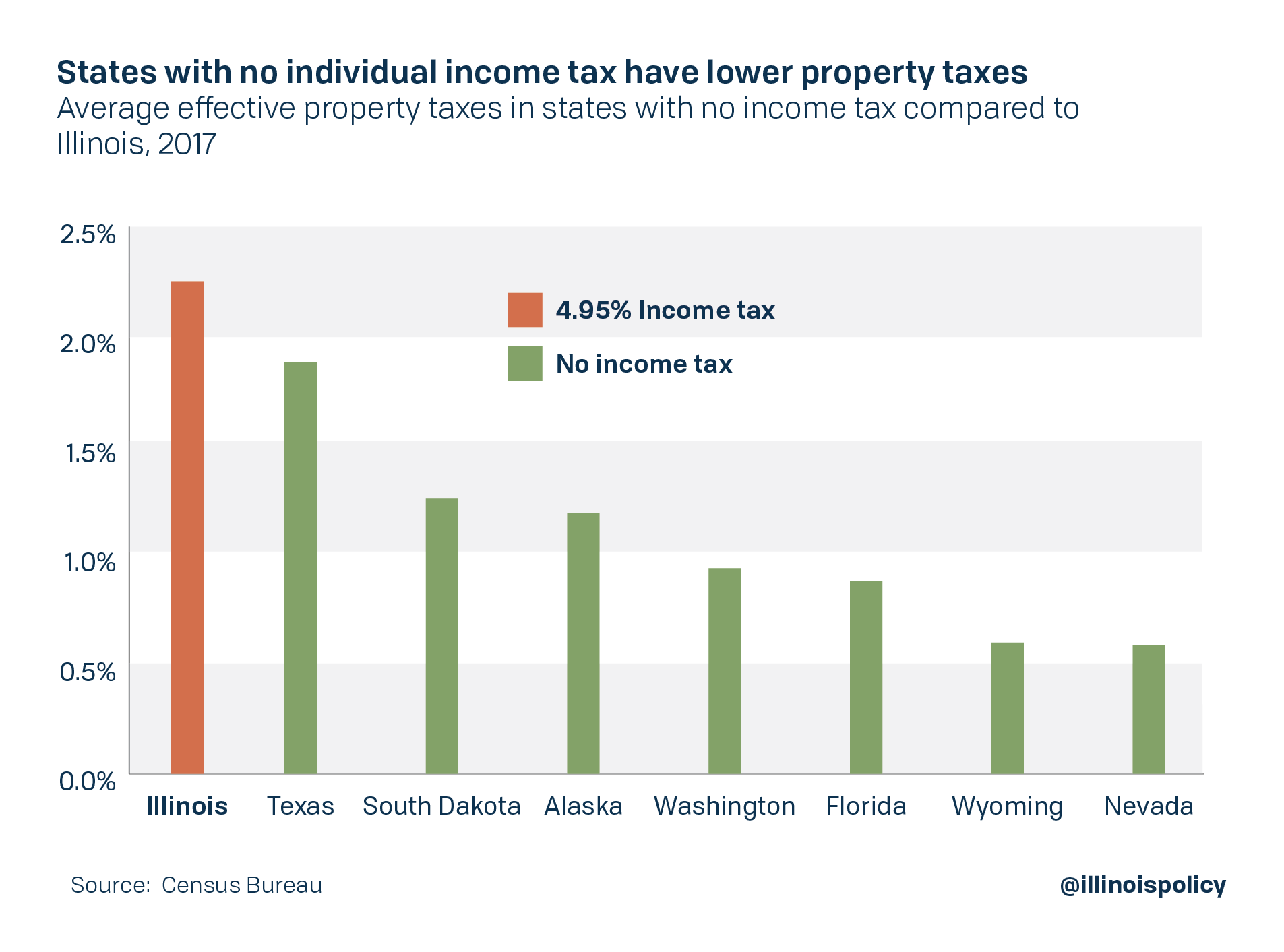

Illinois was home to the nations second-highest property taxes in 2021. A date other than June 30 Form IL-1120 is due on or before the 15th day of the 4th month following the close of the tax year. 45 penalty interest added per State.

Q3 Jul - Sep October 20. Governor JB Pritzker announced Thursday the state. When are taxes due.

Q2 Apr - Jun July 20. Pritzker announced today that his administration is extending the individual income tax filing and payment deadline from April 15 to May 17. Pat Nabong Sun-Times Cook County property tax bills were posted online Tuesday after months of delays.

Tax Year 2021 First Installment Due Date.

Where S My Refund Illinois H R Block

Tax Collection For Orders Shipped To Illinois Effective January 1 2021 Us Announcements Amazon Seller Forums

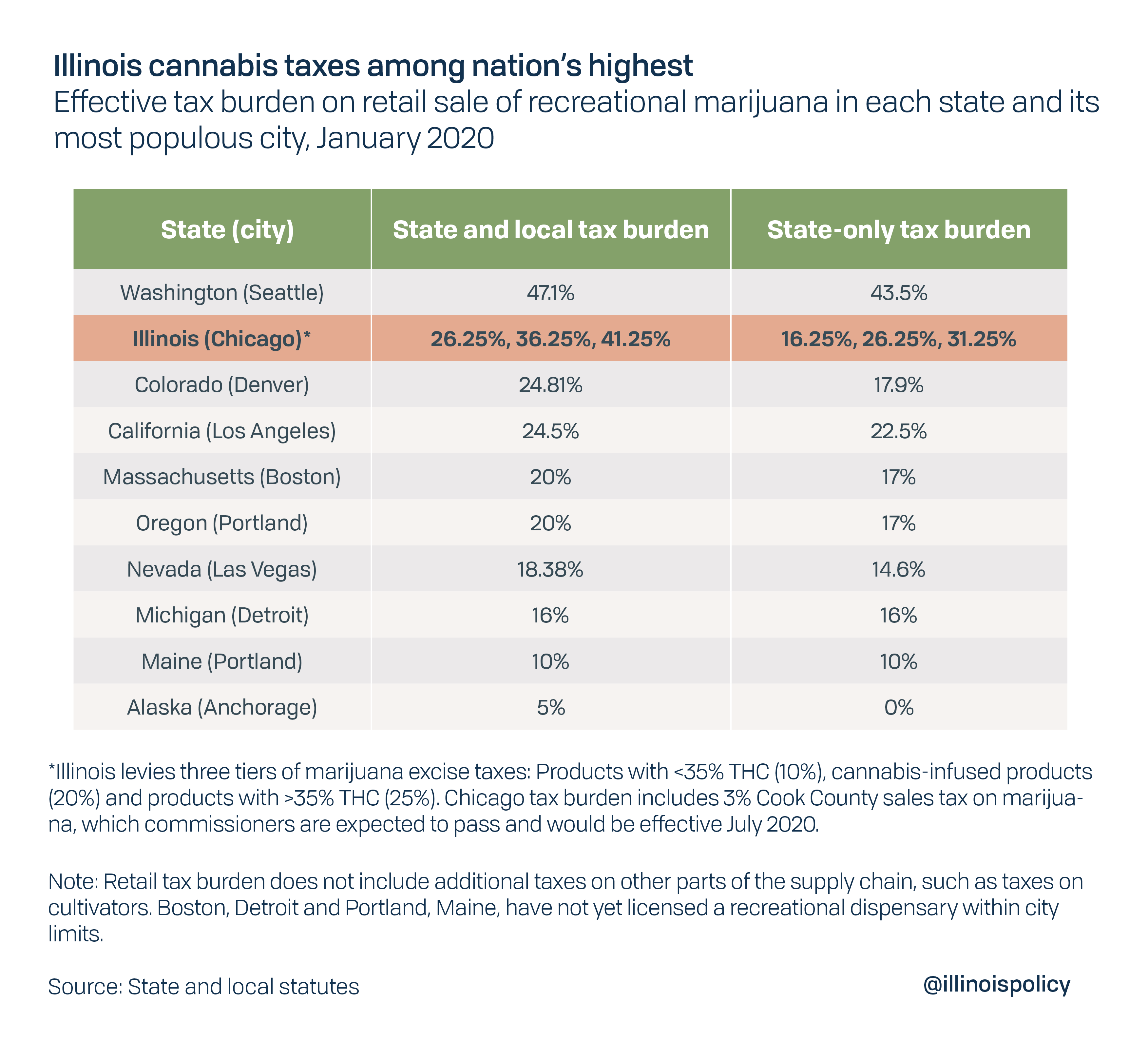

Illinois Cannabis Taxes Among Nation S Highest Could Keep Black Market Thriving

Low Income Housing Tax Credit Ihda

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Ildeptofrevenue Ildeptofrevenue Twitter

Delinquent Property Tax Search Champaign County Clerk

Ildeptofrevenue Ildeptofrevenue Twitter

Study Illinois Property Taxes Still Second Highest In Nation

Withholding Income Tax Return Due Date Filing Reminder

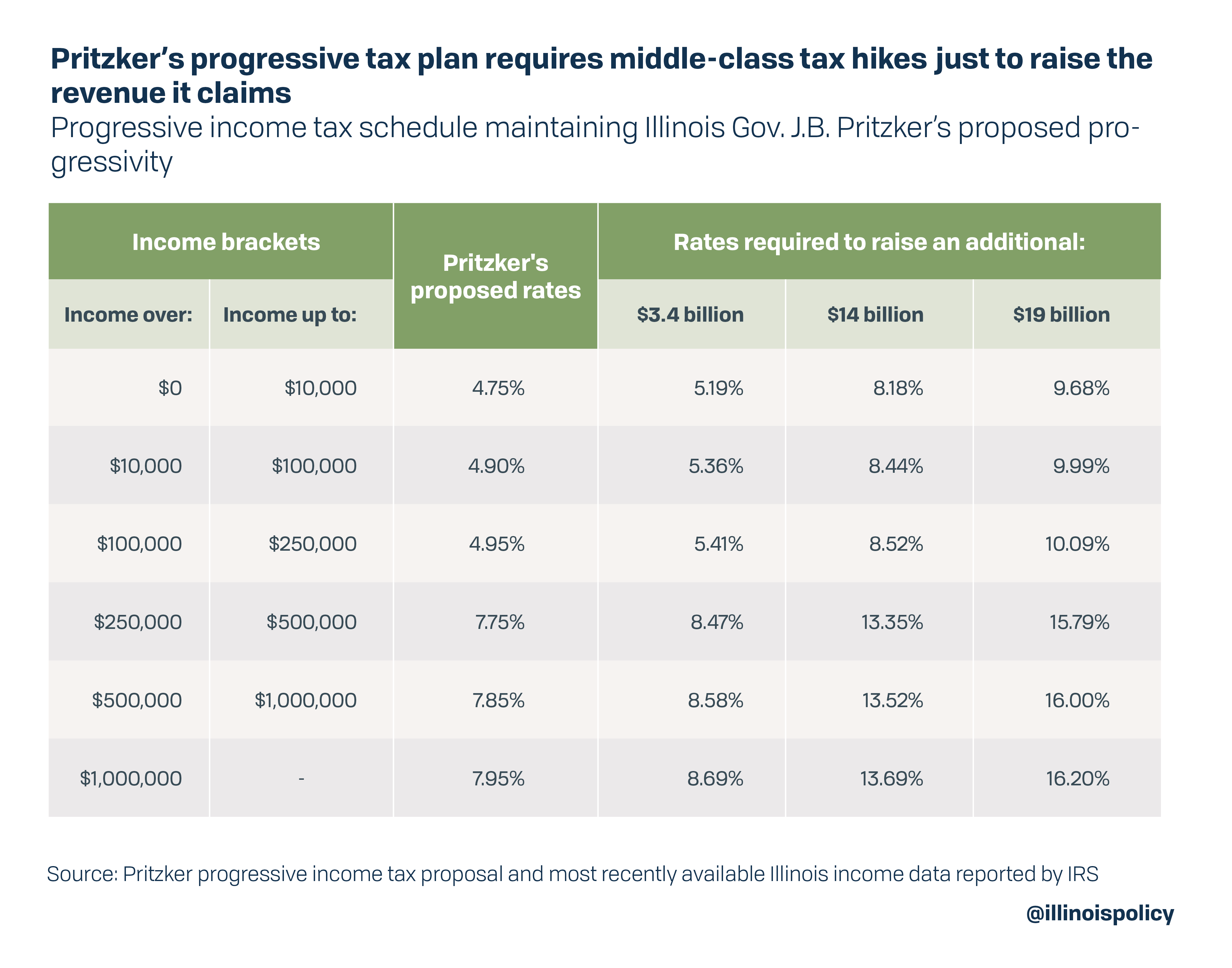

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

Pritzker Fair Tax Would Cost Typical Illinois Family 3 500 Cost State Economy 286 000 Jobs Illinois Policy

How To Start An Llc In Illinois And Save On Taxes In 5 Easy Steps According To Experts

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Us Tax Deadlines For Expats Businesses 2022 Updated Online Taxman